- #How to record expenses in quickbooks pro 2017 how to

- #How to record expenses in quickbooks pro 2017 software

- #How to record expenses in quickbooks pro 2017 professional

The Retailer’s Inventory Management Guide: How To Use Your POS To Maximize Success. #HOW TO ENTER EXPENSES IN QUICKBOOKS PRO 2012 HOW TO#

#How to record expenses in quickbooks pro 2017 software

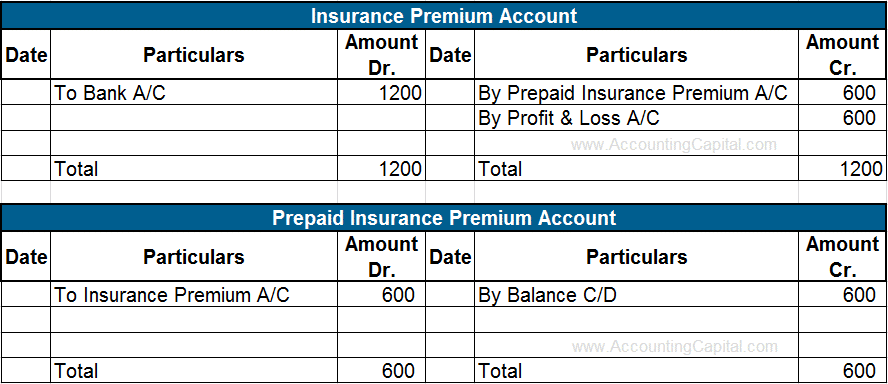

Journal entries, as an accounting concept, can take a while to grasp. The good news? QuickBooks creates almost all of your journal entries for you automatically. The other good news? If you do have to make a journal entry, it only takes five easy steps. When To Create A Journal Entry In QuickBooks Pro This post will explain when you need to create a journal entry in QuickBooks and walk you through the journal entry process. In double-entry accounting, a journal entry is used for logging which debit and credit accounts are affected by a given transaction. A journal entry is needed each time money is transferred between income and expense accounts. Journal entries are also recorded when money is transferred from an asset, liability, or equity account to an income or expense account. Journal entries are kept in a general ledger, which provides a complete record of the financial transactions of your business. Journal entries are critical for an accurate record of your financial transactions. if the web store is an extension of the present store, will sell inventory from it, etc - then no it is the same company, so the same company file. Journal entries are also important because they are the basis for many of your business’s financial reports. If the web store is a separate business, then yes two separate company files, separate inventory, etc etc, and yes you file a schedule C for each. Balance sheets, income statements, and cash flow statements all rely on accurate journal entries.īut what if you’re new to accounting? Maybe you have a slight grasp of the concept, but you don’t feel confident enough in your skills to input every journal entry accurately. In most cases, QuickBooks takes care of all the double-entry accounting behind the scenes. If we use the command shortcut Ctrl + Y, we can see the journal entry that QuickBooks automatically created for this transaction: Whenever you enter a transaction (such as an invoice or bill) in QuickBooks, the software automatically creates a journal entry for you. The entry tells us that Accounts Payable was credited $585.21, and the Auto and Truck Expenses account was debited $585.21. The debits and credits balance.Īgain, QuickBooks creates an automatic journal entry for every transaction entered in QuickBooks. #HOW TO ENTER EXPENSES IN QUICKBOOKS PRO 2012 SOFTWARE#Īdditionally, the software will adjust the journal entries if you edit or change the transaction. Records an expense (credit) and the obligation to pay later (debit) B.

#How to record expenses in quickbooks pro 2017 professional

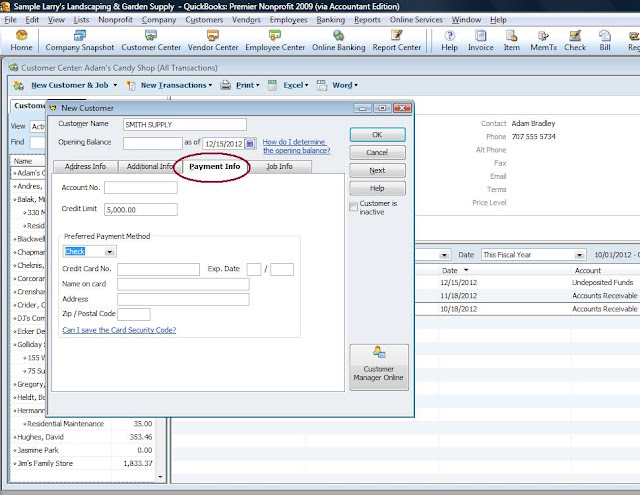

If the bill is from a lawyer, choose Legal Expense or Professional Fees, depending on what's listed in your chart of accounts. For example, if the bill is from your electric and gas company, choose Utility Expense.

Doing so allows you to keep a record of invoices received, notes them in accounts payable and debits the expense account for the bill amount. The easiest way to enter expenses into QuickBooks is to use the Enter Bills function.

0 kommentar(er)

0 kommentar(er)